What happened in the 2010s?

decoding a mystery

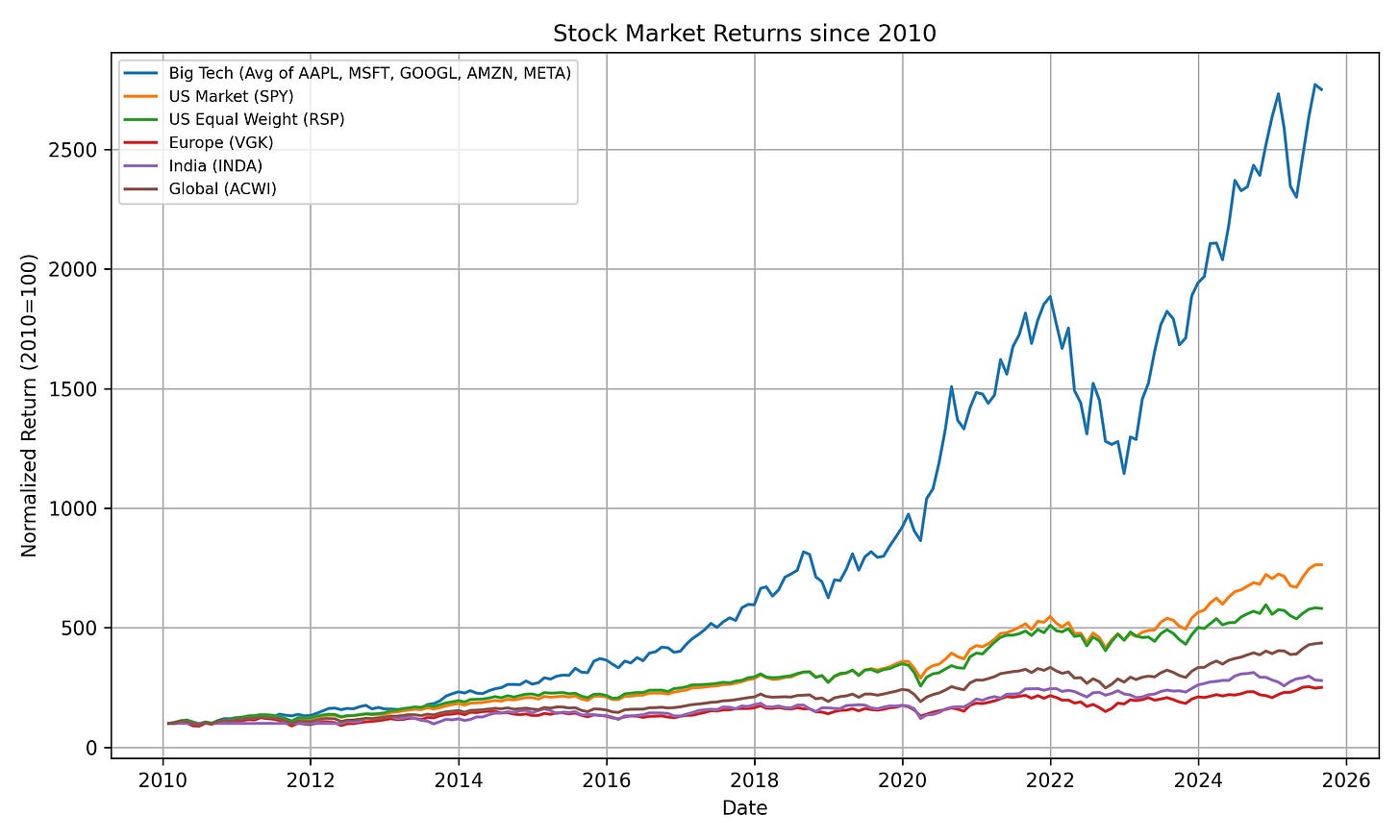

One reason I love the financial markets is that it's the best representation about the future, which makes it the perfect tableaux to understand big developments that changed the world. At any scale you look you learn something true about the world. One specific story that's stood out, brought to light by the markets but deeply impactful in the real world, happened in the last decade and half. Which is that no matter how you look at the figures, there has only been one winner in the markets in all that time. The US capital markets. And in that market, 5 companies, Meta, Google, Apple, Amazon, and Microsoft, basically accounted for all that's good about the market.

Which is really weird! Everything else in this market put together, including every other stock market in the world, just kind of muddled along, whereas these companies just took over. As Joe Weisenthal of Bloomberg says often, there was only one trade worth doing in the last decade and half.

Isn’t this extraordinary? The average earnings growth for these companies from 2010, remember still some of the largest companies even in 2010, was 17%, compared to around 7% for the rest of the S&P 500. The returns from Europe, India, and the global market excluding the US, all hovered around 7–9%, while the outperformance came from a narrow group. The market cap growth for the entire S&P was about 60% led by those five names, and contributed about a quarter of the entire earnings for the 500 companies1.

The question I had was why this turned out to be the case. One answer, the most commonly stated one, is that this was the growth of the digital realm, and this was helped along by the unique dynamics of that digital realm.

Is that true? Well, kind of. Is that enough? Well. It is true that network effects did tie us down into Facebook and Google. Apple did create a walled garden that locked us into itself. Amazon did swallow most of the “mom and pop” stores, online, much like Walmart did a generation before, offline, and with smoother transaction costs.

But it’s also true that “digital realm” was not something that started in the late 2000s. The internet existed. Amazon and Google started in the late 90s. Netscape came before. We even had a whole dot-com boom. We even had Microsoft getting sued by antitrust for internet explorer!

So why didn’t the world get taken over by those companies a decade before? They also had some network effects (remember the browser wars and the ballooning plugins? Some of you might need to ask o3 to teach you). They also had personal websites, even forums, social sites, and games. We had about 17 million sites in 2000, which grew to 200 million in 2010.

This is comparable to the growth of apps too. We had 100k apps in 2010, compared to 2 million iOS apps in 2020, which stayed flat after, at least for Apple.

So what exactly changed? It’s not the “supply” side, which was the fact that we got more websites or more apps.

Was it the increase in data? Not quite, that too seemed a smooth rise. Moore’s Law didn’t seem to hit a kink anytime in the late 00s.

What about the smartphone or mobile revolution? It did change things. A lot. And well, this is slightly more complicated because Apple got to own not just the device, like Dell and Lenovo owned the device before, but also the ecosystem. But this too was a continuation of a trend and not quite a kink? And how did it do it? A new consumer electronics category that got Walmart scale with Ferrari margins is a good answer but the causality is missing.

We did move devices before. From PCs to laptops, in the generation before. I remember updating my PC (and laptop) regularly before to be able to play games or do more on the internet.

What about the necessity or need for more compute? That too rose according to usage. So it can’t just be that.

Was it commerce? Not quite, it grew from late 90s onwards, from $0.5 Billion in 95 to $15+ Billion in 2000, and a steady growth post the dot com bust.

If it’s none of those, then what exactly did change?

One way to think of it might be to look at where the money actually came from. Like, we know FAAMG became the only story in the world, but what made them absolute money gushers?

And when you compare, you can see that the two biggest contributors of revenue are Ads and Cloud. Alphabet and Meta makes 95%+ of their money from ads today, as they did then. Amazon makes a ton of their money also from ads today, $56 billion in 2024 at much higher margins than retail. Microsoft and Apple aren’t the same, but they are also the conduits for enterprises and people, respectively, to get into the space.

And what that means is that the growth in earnings and equity value came almost entirely from monetising people’s attention. About half from monetising eyeballs and the other half from developing the infrastructure, primarily to monetise eyeballs. To run nightly ad auctions in <100ms Google built GFS, MapReduce, BigTable, Borg. Same for Amazon: to keep every micro-service independent the company rebuilt its internal IT as service-oriented “primitives,” then exposed them to outsiders in 2006 as Amazon Web Services. And that created the next growth trajectory.

You could have just as easily seen Samsung make the money instead of Apple or Oracle make the money instead of Microsoft, but Google and Meta caught almost all of people’s attention. If you were any company who wanted people at large to know about you, you had to pay them. And you had to pay them an increasing amount of money every year because it was auctioned off. Perfect market pricing.

So if we think about what actually changed, it’s the fact that people’s attention got more monetised. And monetisable. And if you think about it like that, then suddenly the rise of “Big Tech” can be seen as a monocausal event2.

Namely:

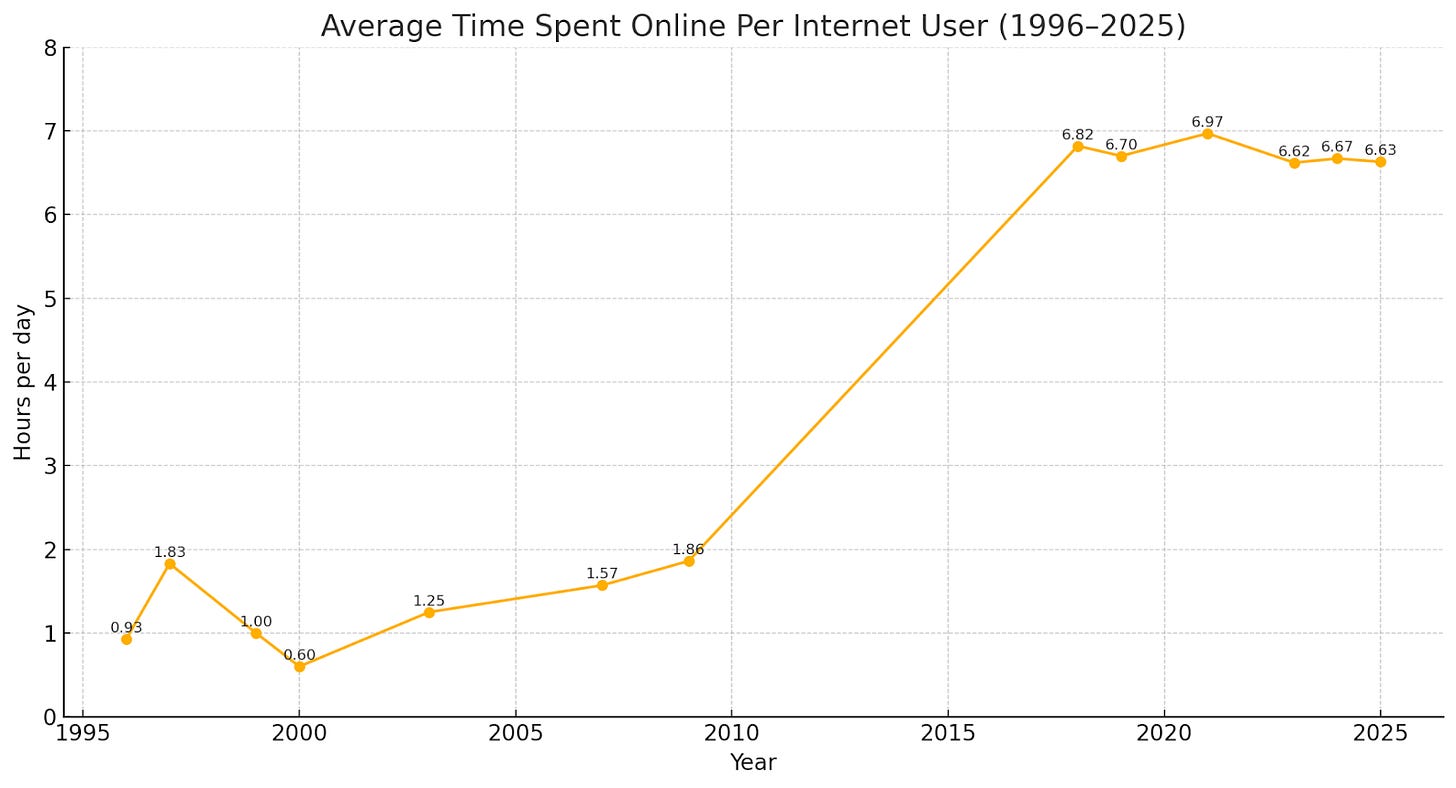

The smartphone meant that more people spent more time online. The development of better processing, the cloud itself, better devices, more websites, social media, video-on-internet, they all were parts of the “why” people spent more time online. But the base shift was in consumer demand. From the dot-com years to smartphones the online time grew 6x.

What made people spend that time? The web itself became the place where we did everything. First for information and then for socialisation.

Plenty of science fiction stories talk about the enclosure of the commons and commodification of our existence; they’re part of our dystopian nightmares.

We’ve long had a fascination with the very fact of our existence getting monetised as corporations get powerful. Total Recall, in 1990, based on Philip K Dick’s book, talked about how you had to pay to breathe oxygen. The Space Merchants in 1950s talked about a society where access to space outside was monetised. Snowpiercer had access to windows in their post-apocalyptic train being rationed and only accessible to the rich. Logan’s Run had the right to age, or walk freely, being stripped! Oryx and Crake had you pay corporate run compounds for clean air and food.

None of this is true. We still live relatively free lives in the physical world. Dystopian science fiction remains just that.

But we have more commons today than just the physical. That’s what changed. The average American adult 7 hours a day looking at a screen, more than half of that on a mobile. FAAMG controlled over 85% of that time spent online in the US. Facebook alone controls 4 of the 5 most downloaded apps globally. Texting is our primary mode of communication. More than half of the US teens say they spend more time with friends online than in person.

This just underscores how since 2010 or thereabouts we started having two legitimately different lives. One offline, and one online. We can see the kink in the chart. In the 90s the enthusiasts might have spent half an hour, an hour, two hours, online per day, but they were outliers. But now that’s well below the average.

Now, we’re not just using the internet as if it’s a tool, it is a second life. Sometimes a first. Everything from work to shopping to relationships to friendships happens online. We got games and news and socialisation and video all provided to us through it. But unlike the fiction imagined in Total Recall or Space Merchants, it’s closed to what was shown in Oryx and Crake, but for the digital world. Rightfully so in many cases, because it is expensive! This is a far more profound shift than just using a different Device. It is a complete change in the environment itself in which way we live. I think a large chunk if not the majority of my activities online happen via my Mac, not my phone.

But as in the chart above, the number of hours spent online has also been plateauing, since the late 2010s. Which is also when the competition for our attention has grown the fiercest? Because it’s no longer rising-tide-lifts-all-boats, but a red ocean.

Herbert Simon had what seems not to an extremely prescient observation from the 1970s that "information consumes attention". This has now reached its logical conclusion.

But it also means we should ask, what’s next? If it’s a continuation of that trend and we start seeing people spend more than a third of their life, or half their waking life, online, then we might see an increasing trend of earnings growth. Without that, maybe not, until we either hit that number for the whole world and companies still continue to spend more on reaching those people because on average they’re able to spend more money.

I don’t know what’s next. Attention-to-earnings ratio is not one to one. And time-plateau doesn’t mean a revenue plateau. So maybe a large part of what we see as attention above gets redirected into agents acting on our behalf. Granted, they are likely to be less impacted by advertisements per se, but there will be new methods of economic rent-seeking. Maybe it’s more ambient computing so the number of hours spent online blur into all hours which also blur with our offline lives.

Is that all just a continuation of this trend, or a new trend entirely? Could there emerge a new chokehold in this economy? Maybe the types of attention are different too? Like more on review and decision making and less on active selection.

Maybe the fact that we’ll move into a world where computation is everywhere means that we’re no longer the decision makers. Maybe the device with which we access becomes central, though that seems unlikely. Maybe it means the way information is stored and updated and transmitted itself will change, so it’s no longer the same free for all where each provider puts something out there so they will find their audience3. Or when our agents are the ones who surf the web on our behalf, maybe we’ll need a whole new set of tools and methods to access information from across the world. Or something altogether stranger we can’t quite conceive of yet4.

History says it’s impossible that we won’t find one. Meanwhile, attention will keep us going.

Peak 2024 P/E premium of Mag 7 over S&P 493 hit 2.2x identical to the spread between US and Europe; the arbitrage is in the earnings, not the multiple.

In 2024 ads + cloud contributed 91 % of Alphabet's EBIT, 98 % of Meta's, 66 % of Amazon's, 37 % of Microsoft's. Remove those segments and their five-year EPS CAGRs converge toward the index median.

Welcome to Strange Loop Canon by the way.

I have a lot more thoughts on what this might shake out to be, but that's perhaps for another post if y'all are interested.

I think you're exactly right but maybe I'm missing something in wondering if the distinction isn't online v. offline but social media vs. other online communities that could have flourished. In my own field, higher ed, I wrote some years ago that universities should not have ceded so much online real estate to social media (Facebook) at the cost of their own campus community (seminar discussions, late night academic debates, gatherings on the quad). Even now, Facebook and Twitter (and maybe now BlueSky) are the places so many academic debates take place when they used to take place on campus. If the university role in "raising" the level of conversation about serious issues is diluted, that's partly what happened. Is social media more democratic, with fewer gatekeepers? Sure. But who profited from this and who lost status. https://www.insidehighered.com/views/2021/02/16/colleges-should-build-their-own-social-media-platforms-instead-relying-facebook

I love the way you structured this as a detective story at the start.

I’m afraid I have nothing clever to add; I just enjoyed reading it, and wanted to tell you.

Well done, carry on.