Anomie

the vibes they are a-changin

I sometimes think about people whose careers started in the ‘90s. They had a roaring decade of economic growth. And even if they did not participate in the dot com boom they still had the opportunity to invest in Google, Amazon or Microsoft low valuations. They had the potential to generate extraordinary wealth purely by dint of public market investments or buying a house in Palo Alto.

We can contrast that with the 2010s. Decade was roaring again; the stock market actually did quite well. But the truly outsized returns were almost entirely stuck within the private markets. Much of venture capital over the last decade has been privatizing the previously public gains, of a company going from 1 billion, 5 billion, 20 billion to 10, 50, 100 billion market caps or more. In fact the last big IPO that happened was Facebook in 2012 and that was already outsized, being valued at five times that of Google’s by the time the public could get their hands on it. In fact one of the best trades that existed perhaps ever was buying its stock when their market cap fell to 300 billion or so a few years ago.

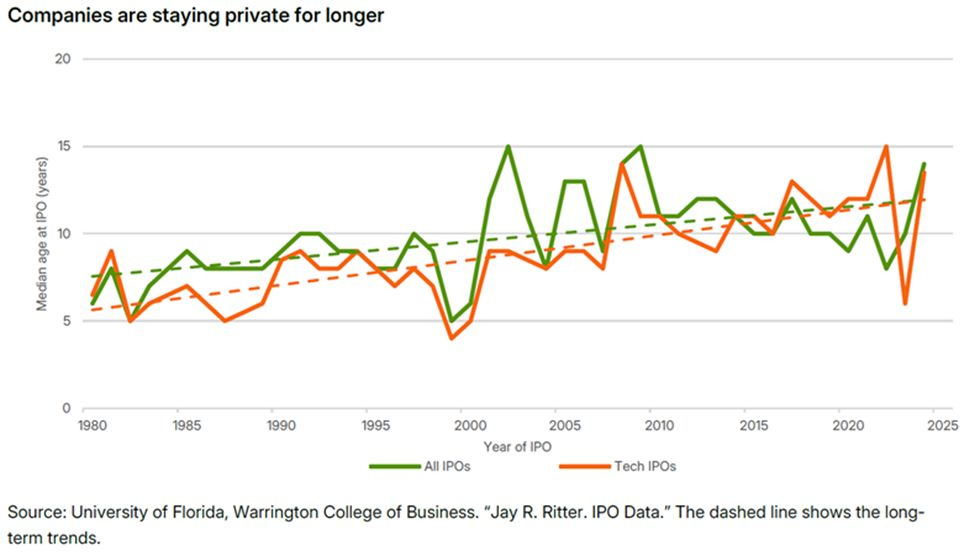

Or, looked at another way, in 1980 the median age of a listed U.S. company was 6 years; today it is 20.

Meanwhile every other major company remains private seemingly endlessly. Even now Stripe remains private, so does Databricks, so does SpaceX … They give their employees liquidity, provide some high fee methods for others to invest via SPVs or futures, even report the occasional metric. And if you want any exposure you better be prepared to pay 5% fees and then probably 2 and 20 on top of it for the SPV.

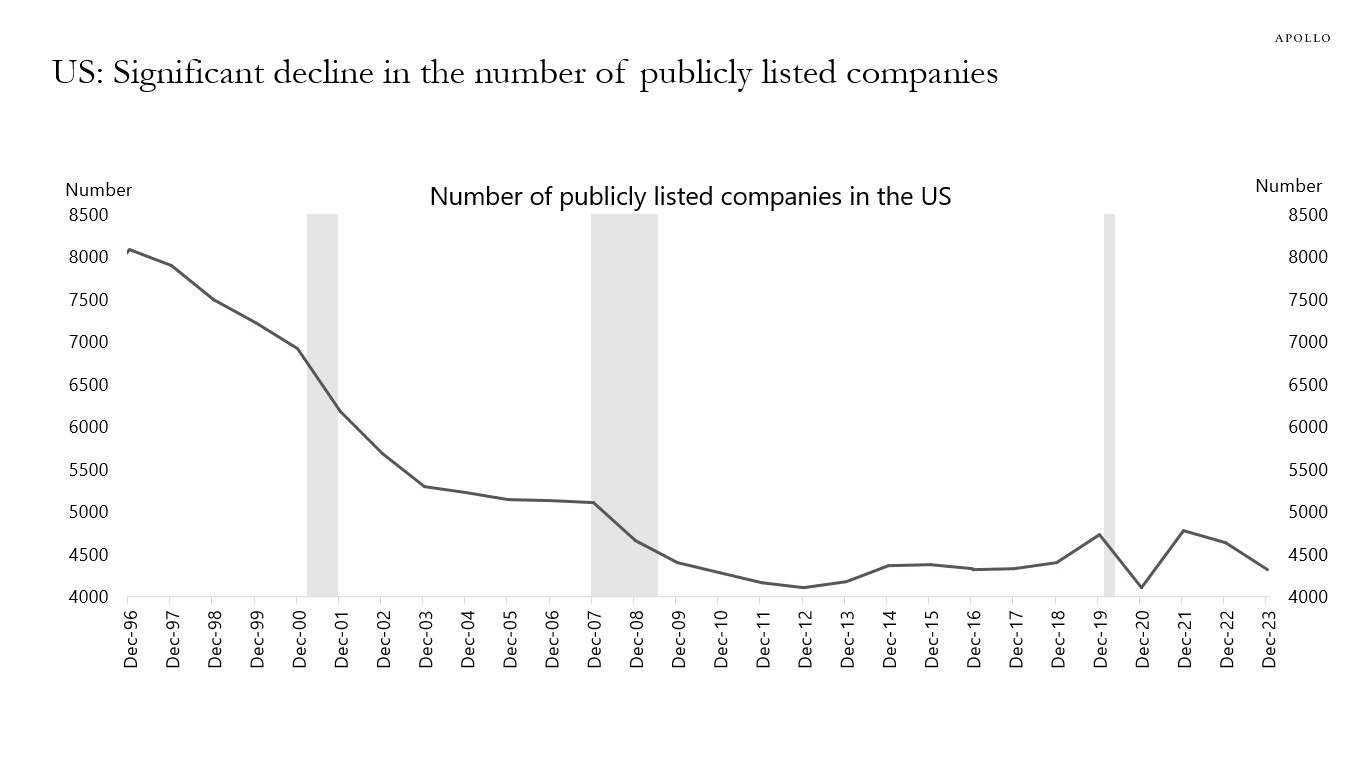

Now, the number of people investing in the market has gone up so maybe it’s just alpha erasure. So it’s not to say there are no alpha generating investments at all. There absolutely have been 10 baggers or more in the public markets, Palantir shot up like crazy. But they’re as few as they’re speculative. All the while the number of public companies even has fallen off a cliff.

But it does tell us why meme stocks became a thing. Right? Speculative mania by itself is nothing new, from tulips to Cisco in 2000, but Tesla is a different animal. As was (is) GameStop! It also explains why crypto is a thing, why smart 20 year olds are yoloing their bonus checks into alt coins or short expiry options.

It’s because there’s a clear sense of now or never. This was the entire crypto ethos. Don’t build a Telco, create a Telco token! Even the rise of AI heightens this! If you managed to join Openai in 2020 you’re a multi multi millionaire, you won the lottery. If you didn’t, it’s over. If you combine the workforce of the largest labs you still wouldn’t even show up in any aggregate measures.

Back in the days of yore, if you did not manage to get a job at Google in 2005 you could still buy its stock. You had at least the option of gaining from its appreciation assuming you thought it inevitable. Over the last decade and a half there have been multiple generations who succeeded from getting a job at one of these giants and working their way up, and equally and more from people who invested in those giants. That’s what brought about the belief that the arc of history trended upwards.

Today, there exists no such option. There only exists short term manic rises even for the longer term theses. The closest anyone can get to the AI boom is Nvidia, an old stock, which has shot up as the preferred seller of shovels in this gold rush. The closest anyone can get at an institutional scale even is Situational Awareness which bought calls on Intel Capital and has also rightfully shot up. These are in effect synthetic lottery tickets the public market was forced to invent because the real lottery, OpenAI equity, is locked. The claim is not that returns vanished, but that access to the tails shifted.

But from the perspective of most people on the street they either work for one of the large labs in which case you are paid extraordinarily well, enough to almost single-handedly prop up the US economy, while for everybody else you are at best treading water. And by the way, the broader solutions to try and fix it by adding private equity to 401k portfolios is as risky as it is expensive. Not to mention opaque. The roaring parts of the economy are linked, sure, to the public markets and the broader economy benefits, but at a distance.

I wrote once about Zeitgeist Farming, a way that seemed to be developing to get rich by betting on the zeitgest and doing no real work, as a seemingly emergent phenomena in the markets, and it seems to have continued its dominance. And we see the results. It’s the Great Polarisation.

I’m obviously not saying that life sucks or that folks who don’t are destitute, this is not a science fiction dystopia, far from it, but it is very clear that the fruits of our progress seem fewer and coarsely distributed. And when they’re not, the feeling of there being haves and have nots gets stronger. It might well be that the haves are only a tiny tiny tiny minority who are doing exceedingly well, while the majority are doing just fine, great even historically speaking, but the “there but for the flip of a coin go I” feeling remains strong.

This is what’s different to the ages before. Physics PhDs went into wall street and made billions, but it didn’t feel like they hit a lottery as much as they were at the top of their profession, a profession that was different, even priestly, in its insularity. AI, rightly or wrongly, doesn’t feel like that.

It doesn’t help that the rhetoric from all the labs is that the end is nigh. The end of all humanity, if you believe some, but at least the end of jobs according to even the more level headed prognosticians. Leaving aside how right they might end up being, that’s a scary place to be.

While this particular rhetoric is new it taps into a fear that’s existed, latent, inside many over the entire past decade and half. We all know folks who joined so-and-so company at the right time and rode the valuation up. We also know incredibly smart folks who didn’t, and who didn’t “get their bag”.

Crypto alt-coin bubble might have seemed a cause for the societal sickness, but it’s not. It’s a symptom. A symptom of the fact that to get ahead it feels, viscerally, like you have to gamble.

After all, when life resembles a lottery, then what’s left but to play the odds.

I've worked a long time in the secondary markets and I've written a fair bit about this problem (delayed IPOs, exclusion of public market investors), but I think there's a bit of ex post facto reasoning on here.

Companies like Palantir that have 10xed are "speculative"... but the for people in the 90s, "they still had the opportunity to invest in Google, Amazon or Microsoft at low valuations" ignores the fact that they were *equally* speculative at the time.

Companies are going public at 10x the valuations, but the markets are 10x bigger. Ten years ago, we didn't have a single $T company, but now we have 11 of them.

And as it has always been, the right move for 99% of investors is to invest in a broad index. The 25-year return of the S&P and the 10-year return of the S&P are, coincidentally, *identical* at 12.9% IRR (not including dividends).

I do agree that there are a whole host of other issues that pose structural issues with building wealth — the decaying value of a college education, AI taking all the knowledge work, what does money mean post AGI, student loans, etc.

But I've gradually come to the conclusion that the private markets concern — while something to address — isn't as much of a society-shaking issue as I previously thought.

Great article, loved it. I think you diagnosed a huge part of my psychology here.

The "no gamble, no future" ethos is difficult to trace.

Various LLMs say it comes from Poker, notably one Ren (Tony) Lin who adopted it as his catchphrase, but I recall hearing this in M:tG circles as early as 2008-09; so it was infiltrating the zeitgeist even back then. While impossible to unproblematically pin this psychological mode to any given culture, it would not surprise me if there's some East Asian influence at work here.

Whether it comes from outside or entirely home-grown, the United States (and the West more broadly) is now thoroughly suffused in this kind of thinking. One could also point to Taleb and his popularization of taking into account the long tails in probability distributions.

This way of being is pretty cursed and sociologically unsustainable (we see signs of this everywhere).